As of January 16, 2024, the share price of Angel One Ltd experienced a substantial decline of over 14% in a single day following the release of Q3 results, particularly in Profit After Tax (PAT). Despite this downturn, the company has demonstrated a notable 14% (260 Crore) growth in consolidated profit Year-over-Year (YoY).

In response to its financial performance, Angel One Ltd has declared an interim dividend of ₹12.7 per share and set January 23 as the record date for eligibility to receive the dividend. This marks the third dividend distribution by the company in the 2023-24 financial year.

In this article, we delve into a comprehensive analysis of Angel One Ltd share price targets for the years 2024, 2025, 2026, 2027, 2030, 2040, and 2050. Our examination spans various perspectives, including financial metrics, fundamental analysis, technical analysis, and more.

Table of Contents

About

Angel One Limited, formerly known as Angel Broking Ltd, was officially listed on both the NSE and BSE on Monday, October 5, 2020. This company operates within the financial services sector, providing a range of services, including stock broking, trading, commodities trading, and IPO management. It holds a prominent position as the largest listed broker in India. Notably, other leading brokers in the industry, such as Zerodha and Groww, have yet to make their debut on the stock exchange.

| Founded | 8 August 1996 |

| Sybmol (NSE) | ANGELONE |

| Owner | Dinesh Thakkar |

| Industry | Financial services |

| Services | Stock Broker Trading, Commodities trading, IPO etc. |

| Headquarters | Mumbai, India |

Also Read : 30% Crash In 2 days, Hold Or Exit. Share Price Target (Long Term)

Financial Details

The Market Capitalization stands at ₹27,962 crores, reflecting the total market value of its outstanding shares. The Stock Price to Earnings ratio (P/E) is 26.6, indicating the price investors are willing to pay for each unit of earnings.

The company’s Return on Capital Employed (ROCE) is notable at 44.0%, showcasing its efficiency in utilizing capital for profitable operations. Similarly, the Return on Equity (ROE) stands at 47.1%, highlighting the company’s ability to generate returns for its shareholders.

With a Debt to Equity ratio of 0.60, the company maintains a balanced capital structure. The total Debt is ₹1,555 crores, indicating the company’s long-term financial obligations.

Foreign Institutional Investors (FII) hold a significant stake at 19.1%, while Domestic Institutional Investors (DII) hold 9.32% of the company’s shares.

The Earnings Per Share (EPS) is ₹126, representing the portion of the company’s profit attributable to each outstanding share.

In terms of performance, the company has demonstrated robust growth with a Sales Growth of 30.9%. These key financial indicators provide a comprehensive overview of the company’s financial health and market position as of the specified date.

| Market Cap | ₹ 27,962 Cr. | Stock P/E | 26.6 |

| ROCE | 44.0 % | ROE | 47.1% |

| Debt to equity | 0.60 | Debt | ₹ 1,555 Cr. |

| FII Holding | 19.1% | DII Holding | 9.32 % |

| EPS | ₹ 126 | Sales growth | 30.9 % |

Also Read : RBZ Jewellers Share Price Target 2024, 2025, 2030, 2040 and 2050 (Long Term)

Financial Statement

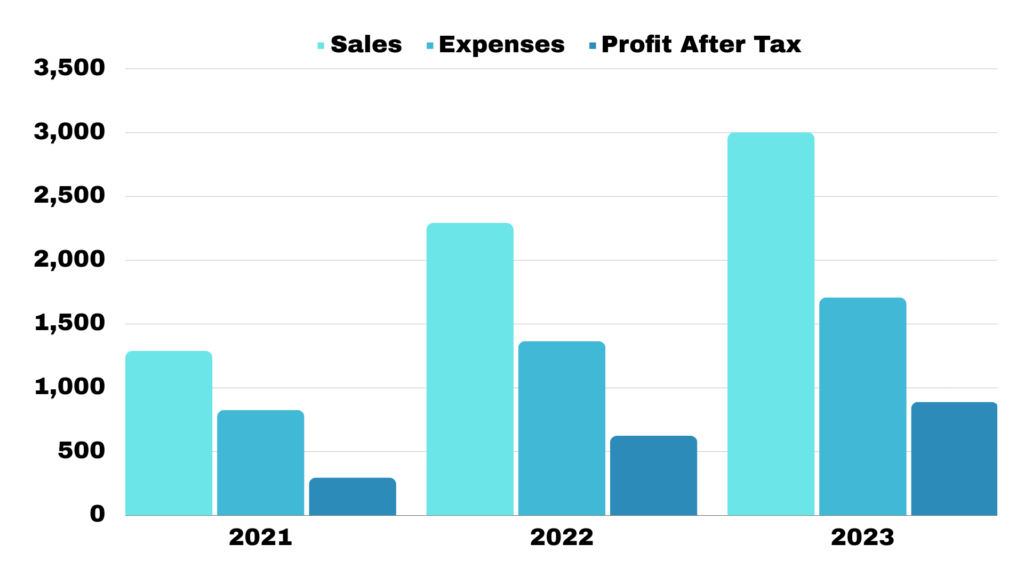

Net Sales:

In 2023, Net Sales increased by approximately 30.43% compared to 2022, reaching ₹3,002 crores. This marks a substantial growth from ₹2,292 crores in 2022. Furthermore, there was an impressive rise of about 132.23% from ₹1,289 crores in 2021.

Expenses:

The Expenses for 2023 amounted to ₹1,708 crores, indicating a rise of around 24.98% from 2022 (₹1,366 crores). Compared to 2021 (₹826 crores), there was a substantial increase of approximately 106.11%.

Profit After Tax:

The Profit After Tax in 2023 reached ₹890 crores, showcasing a growth of about 42.40% from 2022 (₹625 crores). Moreover, there was a remarkable surge of approximately 200.00% compared to 2021 (₹297 crores).

| Particulars | 2023 | 2022 | 2021 |

|---|---|---|---|

| Net Sales | 3,002 | 2,292 | 1,289 |

| Expenses | 1,708 | 1,366 | 826 |

| Profit After Tax | 890 | 625 | 297 |

Also Read : Bajel Projects Ltd Share Price target 2024, 2025, 2030, 2040 and 2050

Technical Analysis

Based on the principles of Fibonacci Retracement, Angel One is currently in close range to its immediate support at ₹3198. A period of consolidation within this range is expected before the potential breakout, targeting ₹4360.

EMA values

| EMA | Value |

|---|---|

| 15 Days | ₹3,593 |

| 50 Days | ₹3,193 |

| 100 Days | ₹2,765 |

| 200 Days | ₹2,292 |

Also Read : Wipro Share Price Target 2024, 2025, 2030, 2040 and 2050

Table of Angel One Ltd Share Price Target

On 16 January 2024, Angel One Ltd share price closed at ₹ 3,330. Angel One Ltd has given more than 1300% return from its listing date on 5 October , 2020. Based on our analysis using different methods Angel One Ltd share price target are described in the table.

| Year | Min Target | Max Target |

|---|---|---|

| 2024 | ₹4,123 | ₹4,360 |

| 2025 | ₹4,419 | ₹5,408 |

| 2026 | ₹6,340 | ₹7,030 |

| 2027 | ₹7,523 | ₹9,139 |

| 2030 | ₹10,601 | ₹11,881 |

| 2040 | ₹32,230 | ₹35,232 |

| 2050 | ₹1,08,677 | ₹1,23,228 |

Note: The share price target is subject to financial situations of the company. The prediction is made based on current market situation and financial condition of the company.

Angel One Ltd Share Price Target for 2024:

Minimum Target: ₹4,123

Maximum Target: ₹4,360

In the upcoming year, the company is anticipated to maintain a price range between ₹4,123 and ₹4,360.

Angel One Ltd Share Price Target for 2025:

Minimum Target: ₹4,419

Maximum Target: ₹5,408

Moving into 2025, the projected price range widens, reaching between ₹4,419 and ₹5,408.

Angel One Ltd Share Price Target for 2026:

Minimum Target: ₹6,340

Maximum Target: ₹7,030

Further into the future, specifically in 2026, the anticipated price range expands to ₹6,340 to ₹7,030.

Angel One Ltd Share Price Target for 2027:

Minimum Target: ₹7,523

Maximum Target: ₹9,139

By 2027, the company’s share price is expected to aim for a range of ₹7,523 to ₹9,139.

Angel One Ltd Share Price Target for 2030:

Minimum Target: ₹10,601

Maximum Target: ₹11,881

Looking ahead to 2030, the minimum and maximum targets extend to ₹10,601 and ₹11,881, respectively.

Angel One Ltd Share Price Target for 2040:

Minimum Target: ₹32,230

Maximum Target: ₹35,232

In the long term, by 2040, the company is anticipated to potentially reach a price range between ₹32,230 and ₹35,232.

Angel One Ltd Share Price Target for 2050:

Minimum Target: ₹1,08,677

Maximum Target: ₹1,23,228

Projected into 2050, the minimum and maximum targets suggest a potential price range of ₹1,08,677 to ₹1,23,228.

Positive and Negative Points of Angel One Ltd

Positive

- Healthy Return Metrics: Angel One exhibits impressive return metrics, with a Return on Capital Employed (ROCE) of 44.0% and a Return on Equity (ROE) of 47.1%.

- The Debt to Equity ratio of 0.60 which is less than our benchmark of 0.75 which is a good sign.

- FII’s are increasing their holdings in every quarter.

Negative

- Promoters holding has decreased significantly by 6% in last three years.

Disclaimer

Investing in stock market is risky and subject to the market condition. This article provides an examination of the company for educational purposes only. We are not SEBI( Stock exchange board of India) registered advisors, and this is not an investment advice. We do not provide tips or calls. Before making any investment decisions, please conduct your own research or consult a qualified financial advisor.

FAQs

Q1: What are the projected share price targets for Angel One Ltd in 2024?

A1: The minimum target is ₹4,123, and the maximum target is ₹4,360 for the year 2024.

Q2: How does the share price target for Angel One Ltd change in 2025?

A2: In 2025, the minimum target increases to ₹4,419, while the maximum target rises to ₹5,408.

Q3: What is the anticipated share price range for Angel One Ltd in 2026?

A3: The projected range for 2026 is between ₹6,340 and ₹7,030.

Q4: What are the expected share price targets for Angel One Ltd in 2027?

A4: In 2027, the minimum target is ₹7,523, and the maximum target is ₹9,139.

Q5: How does the share price outlook for Angel One Ltd evolve in 2030?

A5: Looking ahead to 2030, the minimum target is ₹10,601, and the maximum target is ₹11,881.