In this article, we delve into a comprehensive analysis of ITC Ltd share price targets for the years 2024, 2025, 2026, 2027, 2030, 2040, and 2050. Our examination spans various perspectives, including financial metrics, fundamental analysis, technical analysis, and more.

Table of Contents

About

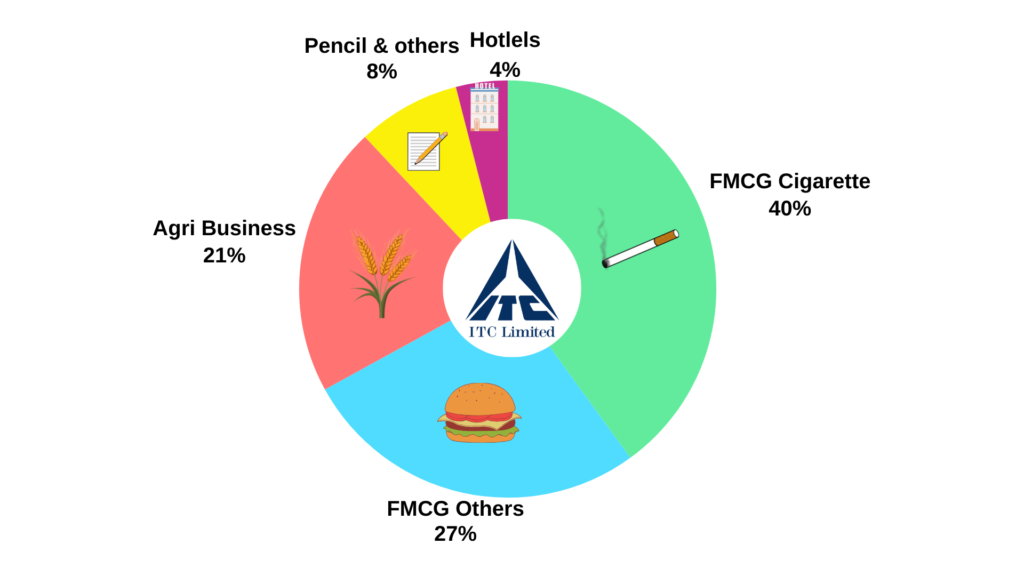

ITC, short for the Imperial Tobacco Company of India Limited, was founded in 1910. It stands as the leading manufacturer and seller of cigarettes in the country, commanding a substantial market share of nearly 75%. The company operates across five key sectors, including FMCG-Cigarettes, FMCG-Others, Agriculture, Hotels Business, and Paperboards and Pencils.

| Founded | 1910 |

| Listing Date | 1st April 1974 |

| NSE Symbol | ITC |

| Chairman & MD | Sanjiv Puri |

| Sector | FMCG (Cigarratte, hotels, packaging, agri business and others) |

| Headquarters | Kolkata, West Bengal |

Also Read : Godfrey Phillips India Ltd share price target 2024, 2025, 2030, 2040 and 2050

Financial Details

With a substantial market capitalization of ₹5,84,420 Crores, it boasts a favorable stock Price-to-Earnings (P/E) ratio of 29.0, which shows that stock might be overvalued at current price.

The Return on Capital Employed (ROCE) stands at an impressive 39.0%, showcasing the company’s efficiency in utilizing capital for generating returns. Return on Equity (ROE) is notable at 29.1%, reflecting strong profitability in relation to shareholders’ equity.

Crucially, the company maintains a debt-free status, with a debt-to-equity ratio of 0.00, and reports no debt, underscoring a healthy financial position.

Foreign Institutional Investors (FII) have a substantial stake at 43.3%, while Domestic Institutional Investors (DII) hold 42.0% of the company.

The Earnings Per Share (EPS) is reported at ₹16.2, lower than industry average of ₹85.

Additionally, the company has demonstrated sales growth of 1.47%, with longer-term perspectives revealing robust growth over the past 3 years (12.8%) and 5 years (10.3%).

| Market Cap | ₹ 5,84,420 Cr | Stock P/E | 29.0 |

| ROCE | 39.0% | ROE | 29.1 % |

| Debt to equity | 0.00 | Debt | ₹ 284 Cr |

| FII Holding | 43.3 % | DII Holding | 42.0 % |

| EPS | ₹ 16.2 | Sales growth | 1.47 % |

| Sales growth 3 years | 12.8 % | Sales growth 5 Years | 10.3 % |

Also Read : Kay Cee Energy & Infra share price target 2024, 2025, 2030, 2040, 2050

Financial Statement

| Particulars | 2023 | 2022 | 2021 |

|---|---|---|---|

| Net Sales | 70,919 | 60,645 | 49,257 |

| Expenses | 45,215 | 40,021 | 32,193 |

| Profit After Tax | 19,477 | 15,503 | 13,383 |

Also Read : Jyoti CNC Automation Ltd share price target 2024, 2025, 2030, 2040 and 2050

Technical Analysis

ITC Ltd has maintained a trading range between ₹440 and ₹480 for the past three months, indicating a period of consolidation. The company may continue consolidating further before potentially experiencing an upward breakout. Potential support levels are anticipated around ₹418 to ₹422. Observing certain price action patterns such as a double bottom, head and shoulders, or a fake breakdown that traps sellers could precede an upward movement. If these signals align, the stock might embark on an upward trajectory from ₹418, aiming for ₹500 by the end of the year.

Also Read : Akanksha Power & Infrastructure Ltd share price target 2024, 2025, 2030, 2040 and 2050

Table of ITC Ltd Share Price Target

As of 26 Jan 24, current price of ITC is ₹ 456.

| Year | Min Target | Max Target |

|---|---|---|

| ITC share price target 2024 | ₹480 | ₹500 |

| ITC share price target 2025 | ₹523 | ₹549 |

| ITC share price target 2026 | ₹560 | ₹588 |

| ITC share price target 2027 | ₹600 | ₹630 |

| ITC share price target 2030 | ₹737 | ₹774 |

| ITC share price target 2040 | ₹1,111 | ₹1,167 |

| ITC share price target 2050 | ₹2,531 | ₹2,658 |

Also Read : Medi Assist Healthcare share price target 2024, 2025, 2030, 2040 and 2050

ITC share price target in 2024:

- Minimum Target: ₹480

- Maximum Target: ₹500

In the upcoming year, the company is anticipated to maintain a price range between ₹480 and ₹500.

ITC share price target in 2025:

- Minimum Target: ₹523

- Maximum Target: ₹549

Moving into 2025, the projected price range widens, reaching between ₹523 and ₹549.

ITC share price target in 2026:

- Minimum Target: ₹560

- Maximum Target: ₹588

Further into the future, specifically in 2026,the anticipated price range expands to ₹560 to ₹588.

Also Read : Nova Agritech Ltd Share Price Target 2024, 2025, 2027 to 2030

ITC share price target in 2027:

- Minimum Target: ₹600

- Maximum Target: ₹630

By 2027, the company’s share price is expected to aim for a range of ₹600 to ₹630.

ITC share price target in 2030:

- Minimum Target: ₹737

- Maximum Target: ₹774

Looking ahead to 2030, the minimum and maximum targets extend to ₹737 and ₹774, respectively.

ITC share price target in 2040:

- Minimum Target: ₹1,111

- Maximum Target: ₹1,167

In the long term, by 2040, the company is anticipated to potentially reach a price range between ₹1,111 and ₹1,167.

ITC share price target in 2050:

- Minimum Target: ₹2,531

- Maximum Target: ₹2,658

Projected into 2050, the minimum and maximum targets suggest a potential price range of ₹2,531 to ₹2,658.

Also Read : VST Industries Ltd share price target 2024, 2025, 2030, 2040 and 2050

Positive and Negative Points of ITC Ltd

Positive

- The company is almost debt free.

- Company has a good return on equity (ROE) track record: 3 Years ROE 25.0%

- Largest Tobacco (cigarette) producer with 75% market share in India.

- 40% revenue comes from addiction based product (cigarette)

Negative

- The company has poor sales growth of 1.4% in last years.

- The company has poor sales growth of 10.3% in last 5 years.

Disclaimer

Investing in stock market is risky and subject to the market condition. This article provides an examination of the company for educational purposes only. We are not SEBI( Stock exchange board of India) registered advisors, and this is not an investment advice. We do not provide tips or calls. Before making any investment decisions, please conduct your own research or consult a qualified financial advisor.

FAQs

Q1: What are the projected share price targets for ITC in 2024?

The company is expected to maintain a price range between ₹480 and ₹500.

Q2: What are the forecasted share price targets for ITC in 2025?

The projected price range widens to reach between ₹523 and ₹549.

Q3: How does the share price outlook for ITC look in 2026?

In 2026, the anticipated price range expands to ₹560 to ₹588.

Q4: What are the expectations for ITC’s share price in 2027?

By 2027, the company’s share price is expected to aim for a range of ₹600 to ₹630.

Q5: What are the minimum and maximum share price targets for ITC in 2030?

Looking ahead to 2030, the minimum and maximum targets extend to ₹737 and ₹774, respectively.